Learn All AboutWhat is APR for a Credit Card?

If you own a card or have considered applying for one, you might have come across the term “APR” at some point. Is an essential aspect of cards that can significantly impact your finances. In this article, we will delve into the world of what is apr for a credit card, demystifying its meaning, importance, and how it affects your financial decisions.

Understanding APR

What is APR for a credit card?

It includes the interest the card issuer charges and any additional fees and costs associated with the credit card. Essentially, what is apr for a card reflects the true cost of credit borrowing.

How APR Works

The APR on a card is expressed as a percentage and is applied to the outstanding balance on your card. If you carry a balance from one month to the next, the APR will be charged on that amount, leading to an increase in the total amount owed. However, paying your card balance in full and on time each month can avoid accruing APR charges.

Types of APR

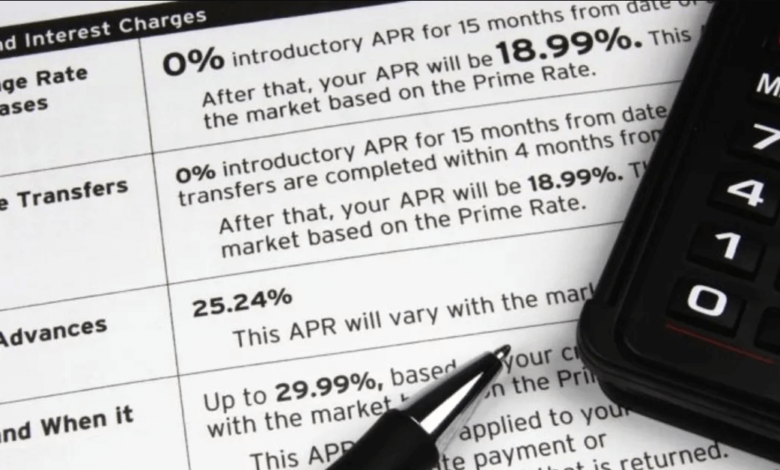

There are various types of APR associated with credit cards, such as:

- Purchase APR: This is the most common type of APR, and it applies to purchases made using the credit card.

- Cash Advance APR: This APR applies when you withdraw cash from your card, which often incurs additional fees.

Importance of APR

your credit card is crucial because it directly impacts the cost of carrying a balance. A high APR means higher interest charges, which can lead to substantial debt if not managed properly. Understanding the APR can help you make informed decisions about when to use your credit card and when to seek alternative financing options.

Factors Affecting APR

Several factors can influence the on your credit card:

Credit Score

The APR you qualify for. A higher credit score generally translates to a lower APR, as it indicates that you are a reliable borrower.

Economic Conditions

Economic fluctuations can influence interest rates, and consequently, the on credit cards. During periods of economic growth, interest rates may be higher, leading to higher APRs.

Market Competition

Competition among credit card issuers can also impact rates. When there is fierce competition, some issuers may offer lower APRs to attract more customers.

APR vs. Interest Rate

It’s essential to differentiate between and the interest rate, as they are often confused. While APR includes the interest rate, it also considers additional fees, making it a more comprehensive measure of the cost of borrowing.

How to Find of Your Credit Card

To find the APR of your credit card, follow these steps:

Checking the Credit Card Agreement

The credit card agreement provided by the issuer will outline the APR associated with your card. Look for the section that discusses interest rates and fees.

Online Research

You can also find your credit card’s APR by visiting the issuer’s website or conducting an online search. Many credit card companies provide this information online for easy access.

Contacting the Credit Card Issuer

If you’re unable to find the through the above methods, don’t hesitate to contact the credit card issuer directly. They will be able to provide you with the accurate APR information.

Managing APR and Card Debt

To effectively manage your card APR and debt, consider the following tips:

Paying on Time

Always make timely payments to avoid late fees and penalty, which can be significantly higher.

Reducing Balances

Work towards reducing your card balances to minimize the amount on which the APR is applied.

Balance Transfers

Consider balance transfers to cards with lower APRs, especially if you have high-interest debts on other cards.

Negotiating with Credit Card Companies

In some cases, you may be able to negotiate with your card company for a lower APR, especially if you have a good payment history.

Common Misconceptions about APR

Several misconceptions about APR should be clarified:

- APR and interest rates are the same.

- Introductory APRs are permanent.

- A higher APR is always a disadvantage.

Understanding these misconceptions can help you make better financial decisions. Read more…

Conclusion

In conclusion, what is apr for a credit card, or Annual Percentage Rate, credit card. It reflects the true cost of borrowing and can significantly impact your financial health. Understanding the and its implications enables you to make informed decisions about credit card usage and debt management.

FAQs

- Q: How is APR different from the interest rate?

- A: APR includes both the interest rate and additional fees, providing a more comprehensive cost of borrowing.

- Q: Can I negotiate the APR on my card?

- A: While it’s not always guaranteed, some credit card companies may be open to negotiation, especially for customers with good payment history.

- Q: Is a higher always a disadvantage?

- A: Not necessarily. While a higher means higher interest charges, it may come with other benefits, such as rewards programs or cashback offers.

- Q: Can I find the APR information on my credit card online?

- A: Many card issuers provide APR information on their websites for easy access.

- Q: How often can the APR on my card change?

- A: The APR can change periodically based on market conditions and the credit card issuer’s policies. Make sure to review your credit card agreement for specific details.