Battery Sales and Service: Powering Your Devices Hassle-Free

In today’s fast-paced world, our lives are heavily reliant on a wide array renewable energy systems. The common thread among all these gadgets is the need for a reliable source of power – batteries. Batteries are the unsung heroes behind the scenes, ensuring our devices function seamlessly. This article delves into the world of battery sales and service, shedding light on the importance of choosing the right battery and maintaining it effectively.

Understanding the Basics of battery sales and service

Types of Batteries

Batteries come in various types, each suited for specific applications. Common types include alkaline, lithium-ion, lead-acid, and nickel-metal hydride (NiMH) batteries. Understanding the differences between these types is crucial to meet your device’s power needs.

How Batteries Work

To appreciate the significance of batteries, it’s essential to grasp how they function. Batteries store energy chemically, releasing it as an electric current when connected to a device. This process involves chemical reactions within the battery, generating the power we rely on daily.

Importance of Battery Lifespan

Battery lifespan varies depending on factors like usage patterns and maintenance. Prolonging your battery’s life not only saves you money but also reduces environmental impact. We’ll explore methods to extend your battery’s longevity in later sections.

Choosing the Right Battery

Battery Capacity

Battery capacity, measured in milliampere-hours (mAh) or watt-hours (Wh), determines how long a battery can power a device. Selecting a battery with adequate capacity is crucial to avoid frequent recharges.

Compatibility

Not all batteries fit every device. Ensuring compatibility is vital to prevent damage to your gadgets and maximize performance. Always consult your device’s manual or a professional for guidance.

Environmental Impact

In an era of environmental awareness, choosing eco-friendly batteries is a responsible choice. Some batteries contain toxic materials, while others are more sustainable. We’ll explore the eco-conscious options available.

Battery Sales: Where to Buy

Physical Stores vs. Online Retailers

When purchasing batteries, you have the option to visit physical stores or shop online. We’ll weigh the pros and cons of each to help you make an informed decision.

Trusted Brands

With a multitude of battery brands on the market, it can be challenging to discern quality. We’ll highlight reputable brands known for their reliability and performance.

Warranty and After-Sales Service

A warranty ensures peace of mind in case your battery encounters issues. We’ll discuss the importance of warranty coverage and the quality of after-sales service provided by different manufacturers.

Maintaining Your Battery

Charging Practices

How you charge your battery impacts its lifespan. We’ll provide tips on proper charging practices to maximize your battery’s longevity and efficiency.

Storage Tips

If you have spare batteries or seasonal devices, proper storage is crucial to prevent deterioration. We’ll share best practices for storing batteries safely.

Signs of Battery Degradation

Recognizing the signs of a deteriorating battery can prevent unexpected device failures. We’ll help you identify these warning signs and take timely action.

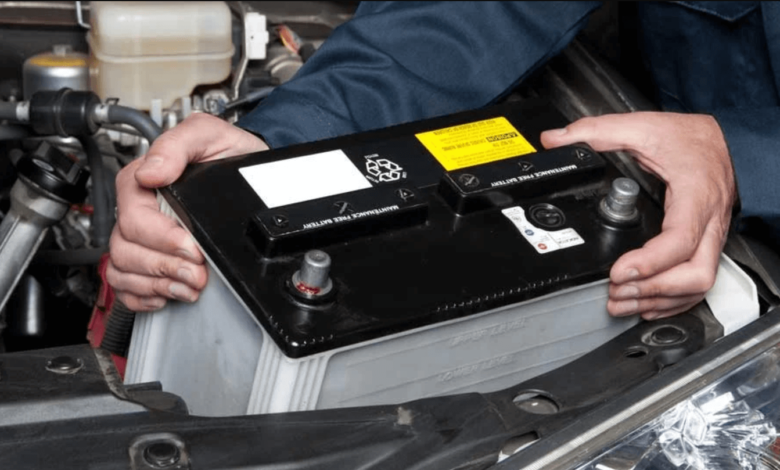

Professional Battery Services

When to Seek Professional Help

Sometimes, batteries face issues beyond our control. We’ll discuss when it’s time to seek professional battery services to diagnose and fix problems.

Battery Repair vs. Replacement

Is your battery salvageable, or is it time for a replacement? We’ll explore the options available when your battery starts showing signs of decline.

Battery Recycling

Responsible disposal of old batteries is essential for the environment. Discover how to recycle batteries safely and contribute to a greener future. Read more…

Conclusion

In a world where battery sales and service power our daily lives, understanding their nuances is paramount. From choosing the right battery to maintaining it effectively and seeking professional assistance when needed, your battery-related decisions impact your devices’ performance and our planet’s health.

FAQs (Frequently Asked Questions)

- How often should I charge my smartphone battery?

- The ideal frequency for charging your smartphone battery depends on your usage. However, experts recommend partial charging cycles rather than full discharges.

- Can I use third-party batteries in my electronic devices?

- While some third-party batteries are compatible, it’s generally safer to use manufacturer-approved batteries to avoid compatibility and safety issues.

- What should I do with old or dead batteries?

- Recycling is the best option for old batteries. Many electronic stores and recycling centers accept used batteries for safe disposal.

- Are rechargeable batteries a sustainable choice?

- Yes, rechargeable batteries are eco-friendly as they reduce waste by being reusable. They are an excellent choice for long-term sustainability.

- How can I extend the life of my laptop battery?

- To extend your laptop battery’s life, avoid overcharging, keep it at moderate temperatures, and perform occasional full discharge cycles.