The Ultimate Guide to Using a Mini Split Cleaning Kit

Are you tired of breathing in stagnant air and dealing with allergies caused by your mini-split system? If so, it’s time to invest in a mini split kit! Regular maintenance can help improve the efficiency and lifespan of your unit while also keeping it free from dust, debris, and other harmful particles. But where do you start when shopping for a cleaning kit? In this ultimate guide, we’ll take you through everything you need to know about using a mini split cleaning kit – from selecting the right one for your needs, to step-by-step instructions on how to clean your system like a pro! So sit back, relax, and get ready to breathe easier with this go-to resource on maintaining your mini-split system.

What is a mini split cleaning kit?

A mini split cleaning kit is a great way to clean your mini-split without having to leave the house. There are several kits available on the market, so it is important to choose one that fits your needs.

Some of the features you may want to consider include:

-The size of the kit

-The type of cleaning chemicals included

-The size and weight of the kit

-The price of the kit

How do mini split kits work?

mini split kits work by using a small motor and a water pump to send high-pressure water through the system. The mini-cleaning kit is connected to the drain pipe of the unit and uses a hose to spray water onto the floor. The water pressure forces dirt, dust, and debris from throughout the system and out into the sink. This method is more effective than using a regular vacuum cleaner because it can get into tight spaces and under furniture.

Mini split kits are also easier to use than traditional vacuums because they do not require any tools or assembly. Users just need to fill up the tank with water, attach the hose, and turn on the machine. Mini-cleaning kits are a great option for apartments, condos, and other small spaces because they can clean quickly and easily.

Types of mini split kits

There are several different types of mini split kits that can be used to clean your home.

One type of cleaning kit is a portable unit that can be moved from room to room. This type of kit is best for small spaces or areas that aren’t easy to access.

Another type of split cleaning kit is a stand-alone unit that can be attached to the wall. These units are best for large spaces or areas that are difficult to access.

A final type of mini split cleaning is a combination unit that can be used in either mode. This type of kit is best for larger spaces or areas that require both portability and accessibility.

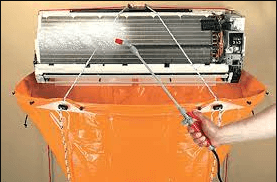

How to use a cleaning kit

The Ultimate Guide to Using a Cleaning Kit

When it comes to keeping your mini split clean, a cleaning kit is essential.

1. Add your cleaning supplies into the mini split’s storage compartment. This will include lint-free cloths, a scrub brush, and a window cleaner.

2. Open up the window and spray the cloth with window cleaner. Wipe down all of the surfaces inside the mini split including the ceiling, floor, and walls.

3. Pour some lint-free cloths into a bucket or sink and wet them before wringing them out. Put them in between each panel of the mini-split to catch any dust, dirt, or debris that may have gotten stuck there during your cleaning attempt!

4. If necessary, use a scrub brush to clean any stubborn messes on the surface of the mini split. Be sure to work from top to bottom and left to right for the best results!

5. Once everything is clean and dry, reattach all of your panels and enjoy fresh air conditioning without worrying about pesky dust mites or other allergens!

The benefits of using a mini-split cleaning

A mini-split system is a great way to heat and cool your home in a cost-effective manner. Here are the benefits of using one:

It’s easy to use – just turn it on when you want heat or cool air, and turn it off when you’re done.

It’s portable, so you can take it with you wherever you go.

If something goes wrong with the system, mini-splits are relatively easy to fix. Read more…

Conclusion

A mini split cleaning kit is a great way to clean your home quickly and efficiently. With everything you need in one place, it’s easy to get started cleaning. We’ve outlined the most important items in a mini split kit and provided tips on how to use them for the best results. So go ahead, start cleaning like a pro!