The Importance of Understanding Check Number Details

Do you know what your number is and why it’s important? Many of us just write a check, tear it out, and send it on its way without giving any thought to the small sequence of digits in the corner. However, understanding numbers can help protect against frauds, keep track of payments made and received efficiently, and avoid unnecessary confusion. In this comprehensive guide, we’ll walk through all you need to know about check number details- from finding them to using them effectively- so that you can manage your finances with confidence!

What is a Check Number details?

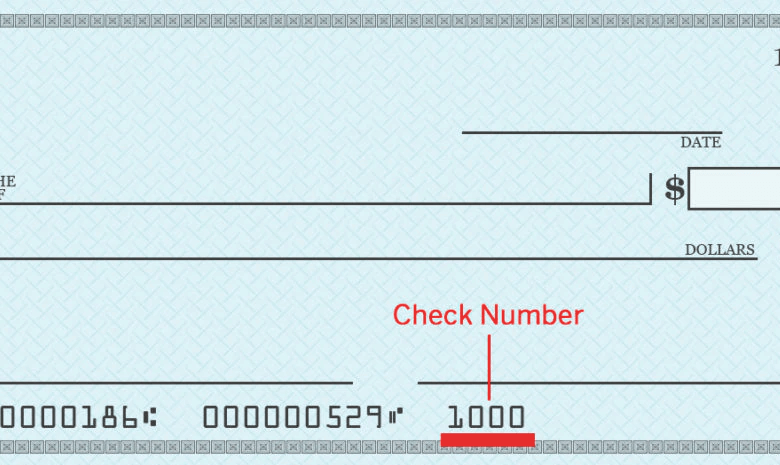

A check number details` is a unique identifier that appears on every printed or handwritten check. It’s usually a small sequence of numbers located in the top right corner of the check. This number helps banks and financial institutions keep track of the checks they process and ensures that each transaction is recorded accurately.

The purpose of a check number is to provide an additional layer of security against fraud. Each time you write a new check, it gets assigned a different number, which makes it easier to detect any unauthorized transactions that may occur on your account.

In addition to being essential for tracking payments, knowing your check numbers can also be handy when you need to reconcile your bank statement at the end of each month. You can match up the numbers on your checks with those listed on your statement, making sure everything balances out correctly.

It’s worth noting that some types of electronic payments don’t have physical checks or even reference numbers associated with them. However, if you’re dealing with traditional paper-based checks or other similar forms of payment processing systems like money orders or cashier’s cheques, understanding what these digits mean could save you from potential headaches down the line!

How to Find Your Check Number

If you’re unsure where to find your number, don’t worry – it’s easy! Your check number is typically located in the top right corner of a personal or business check. It’s usually a small number, ranging from one to four digits.

To locate your check number on a physical paper check, start by looking at the upper right-hand corner of the document. You’ll see several numbers printed there, including your account and routing numbers. The check number will be the last set of digits on that line.

If you are using an online bank service to view your transactions or print checks from home, locating your check is even easier. Simply open up the transaction history for any given payment and look for the corresponding “check” or reference ID. This code should be identical to what appears on any physical copies of that payment.

It’s important to note that not all financial institutions use numbered checks anymore due to increased digital payments and transfers. If this is true for you or if you have further questions about finding your check numbers online versus physically, reach out directly to customer support for assistance!

When to Use a Check Number

When it comes to using a check, the check is an essential piece of information that should not be overlooked. But when exactly should you use this number?

First and foremost, the check serves as a unique identifier for each individual check. This means that whenever you write or receive a check, you need to take note of its corresponding check number.

You’ll need to use your check when reconciling your bank account statement and making sure all transactions match up. Without the proper identification provided by your check number, it would be difficult to reconcile any discrepancies in your account.

Additionally, if there are any issues with a particular transaction made through a certain check, having its corresponding check number will help identify which specific payment was problematic. This can save time and make things easier for both parties involved in resolving any issues.

In short, knowing when to use your Check is crucial for ensuring accurate financial records and identifying specific transactions quickly and efficiently.

How to Use a Check Number details

Once you have located your check number, it is important to understand how to use it. The check serves as a unique identifier for each individual check that you write.

One way to use the check is when balancing your checkbook. By matching up the amount and payee of each cleared transaction with the corresponding entry in your register and verifying that the correct check numbers were used, you can ensure that all transactions are accounted for.

Additionally, if there is ever an issue with a particular payment or transaction, having easy access to the relevant check number can help expedite any necessary resolution or investigation.

Understanding how to use a check number effectively can help keep track of payments and prevent potential issues down the line. Read more…

Conclusion

Understanding check number details is essential for managing your finances effectively. A check number serves as a unique identifier that helps you keep track of your transactions and ensures accurate record-keeping.

The importance of understanding check numbers cannot be overstated. Whether you are writing a personal or business check, make sure always to include the correct information in the designated fields.